As the usual flurry of year-end “Best of”, “Most Popular” and “Most Read” lists came in, I was intrigued to see that tnooz’s ‘Most Popular/Most Commented and More’ Top 20 list for 2012 featured not one, but two stories about the launch of Roomkey.com (and in positions 2 and 4 no less).

I found this quite interesting, not just because we think they have a great name (they are a totally separate company), but because of what we think the hotel industry seems to see in them.

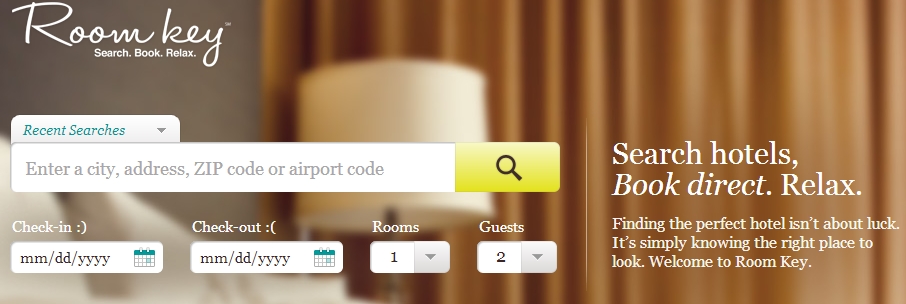

You’ll recall that just about this time last year (Jan. 11th) six of the largest hotel chains in the world unveiled a joint venture online hotel search platform. The collaboration by Choice, Hilton, Hyatt, InterContinental, Marriott, and Wyndham is led by former Pegasus founder John Davis III.

The reaction to their arrival in the marketplace was immediate and extensive with all manner of pundits and commentators weighing in on whether they would make it, how they would market themselves and whether they could get the traction required to make a dent in the very well established OTA’s.

Much of that discussion has been covered in great detail other places so I’ll limit my comments to why I think the hotel industry at large is so intrigued with Roomkey.com, and why they seem to be rooting for them to succeed. When you boil it all out, I think there are probably 3 underlying reasons:

1. The trade sees any pushback on the established OTA’s as a positive:

As observed in a previous post, the degree of change that would occur as the OTA’s became embedded in the travel ecosystem was probably not fully anticipated. Certainly the level of influence they would come to wield vis a vis hotel pricing was not likely foreseen. As often happens when new technology takes hold, consumer behavior begins to change and in the case of the OTA’s, that behavioral change came at a cost to the hotel industry. As things have evolved, it wasn’t just commission costs either, which leads us to the second reason for the interest in Roomkey.com.

2. Roomkey.com is essentially a “direct” channel:

Because it’s owned by the founding hotels themselves (though others have since joined), it’s their inventory that goes into the system and that’s presented to guest prospects when they search. It takes searchers from Roomkey.com to the brand.com website of the properties themselves, and as such provides a number of customer benefits including:

- The hotels’ lowest rates guaranteed,

- No hidden fees or penalties,

- Guests earn their loyalty points & rewards.

Realizing that they needed scale, the founding hotels collaborated to gather eyeballs, not unlike the competitors do in an ‘Auto Mall’ concept; it attracts a motivated customer, then it’s just down to a brand decision. Ultimately, Roomkey.com is less expensive than the incumbent OTA’s, and the guest is coming direct to the brand via a ‘friendly source’.

Which leads in to the 3rd reason I think the trade is interested in how Roomkey.com makes out.

3. Roomkey.com puts the hotels back in control of both pricing and their customer relationship (with a side order of Brand for good measure)!

One of the bigger ‘unintended consequences’ as the OTA’s took hold, was that hotels slowly but steadily ceded more and more control of not just pricing, but worse still, their customer relationship. Rate parity agreements undermined their ability to manage their own pricing, and with it, significantly eroded the positive linkage betweenbrand and price. The consumer’s ability to instantly shop and compare competitors (and those properties that a hotel would NOT consider a competitor), severely undermined the perception and importance of brand distinctions, and the ability to charge for the difference.

Meanwhile, on the customer relationship front, with the OTA’s inserting themselves in between the hotels and their customers, it became clear over time that the ‘ownership’ of the customer relationship had moved from the hotel, to Expedia, Booking.com and others. With that realization, and the knowledge that the hotel’s themselves had been entirely complicit in the shift, came the desire to do something to ‘repatriate’ lost customers, their loyalty and the lifetime value they represent.

Many may see Roomkey.com as a first strike in that direction, which likely accounts for at least part of the significant interest in how they fare.

Founder John Davis is quoted as saying that just 5% of the traffic that gets to brand.com hotel websites converts to a booking (we’ll deal with conversion another day). Whether Roomkey.com can up the amount of ‘direct’ bookings to its founders remains to be seen. What’s far more intriguing as they enter Year 2 though is to see if they have given form to hotelier’s angst over letting control of pricing and customers get away, and created a sense of urgency about finding ways to repatriate customers, reassert control over pricing and put value back into their Brand.

It seems that in 2013, hospitality will continue to reflect the ancient Chinese proverb… “May you live in interesting times”.